Emerging Trends:

Emerging Trends:

Health Plan Cost Savings Strategies

August 15, 2016

Mariana Ancira | Vice President, Account Executive

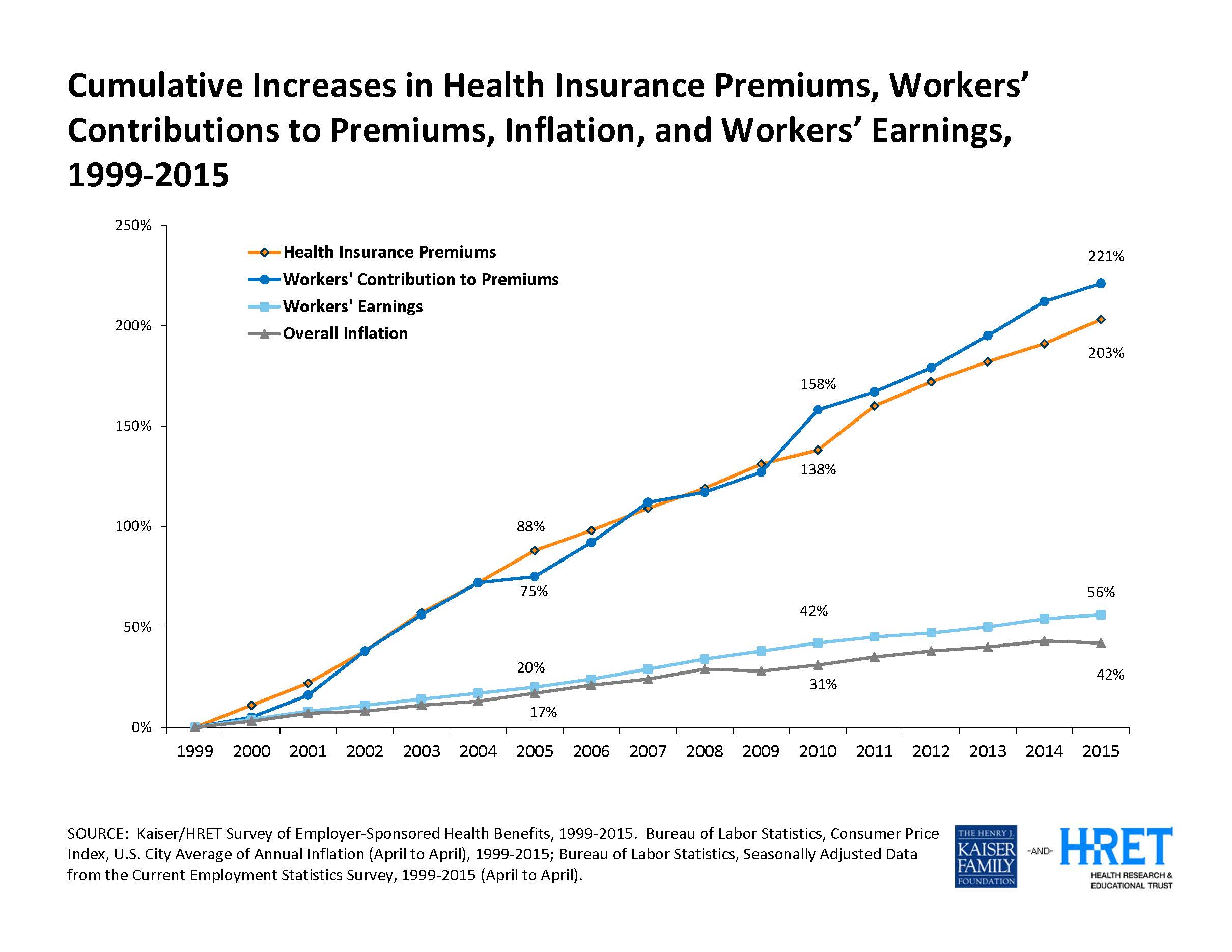

According to the Kaiser Family Foundation’s 2015 Employer Health Benefits Survey, health insurance premiums for employers have cumulatively increased by 65% from 2010 to 2015, vs. overall inflation which has only increased cumulatively by 11% over the same time period.

Causes for this recent disproportion include new expensive specialty medications such as hepatitis C drugs, changing demographics (Baby Boomers maturing), and various implications of the Affordable Care Act (ACA).

The two traditional methods of mitigating premium increases, increasing employee contributions to healthcare premiums and increasing deductibles and out of pocket costs, are now being regulated by the affordability and minimum value rules under ACA. In addition, for many employers, offering competitive benefits is crucial to attracting and retaining quality employees, and passing cost increases along to the employee is an unfavorable option.

Several strategies have emerged in response to the dilemma all employers face at renewal time each year. Most are available to all sizes of employer; others may be limited to large or self-insured employers. However, many insurance carriers are offering these tactics to their small group segments, therefore making a basic understanding of all strategies below advisable for any size of employer offering health benefits:

Consumer Engagement – High Deductible Health Plans

More than 30% of employers offer a high deductible healthcare plan, whether as part of a health savings account (HSA) or a health reimbursement arrangement (HRA) design. These plan designs can reduce costs by promoting consumerism in healthcare purchasing, which gives employees more control of the money spent on their benefits and provides choice. On the other hand, depending upon their design, they can also be perceived as a pure cost shift with employees bearing the burden. In addition, such plans will not make an employer’s large claims disappear. Wellness activities can also be tied into the funding of the HRA or HSA account. Employers must determine whether to do a full replacement plan or a dual choice plan.

Incentives for Wellness Activities

Employers continue to encourage their employees toward healthier living by providing a financial stake for participating in wellness activities. This could include having an annual wellness exam, completing a health risk assessment, measuring biometrics (blood pressure, blood sugar, cholesterol, BMI) either on-site or by their physician, contacting a health coach, or participating in wellness activities or education. The majority of our clients who have wellness programs do provide some type of incentive. Many have begun to offer premium discounts or contributions to an HRA, HSA, or FSA account to those that participate in wellness activities.

Private Exchanges

A Private Exchange is a technology platform that helps employees select or shop for a benefits portfolio that meets their coverage needs. It allows employers to define the amount they are willing to pay towards benefits (a defined contribution), and lets the employee use those dollars to purchase whichever benefits they wish within the options selected by the employer through the Private Exchange. Similarly to the Public Exchanges created for individual and small employers as a result of the Affordable Care Act, these private exchanges offer a variety of plans, benefits levels, and care management. The advantage is that the employer caps what they pay for each employee each year. The disadvantage is that the employer may lose their ability to differentiate by the type of benefits offered, but instead would differentiate only by the amount they contribute. This approach also shifts the purchasing decisions from the employer to the employee, which may be challenging for some employer groups.

Healthcare Cost Transparency

There has been rapid emergence of cost transparency tools, both from insurance carriers and 3rd-party vendors. The objective is to get actual cost and quality information into the hands of the healthcare consumer and motivate them to become more engaged. With more large employers now offering high-deductible health plans, consumers are faced with increasingly large out-of-pocket expenses. Access to price and quality information helps employees save money and make better healthcare decisions.

Reference Based, Cost Plus Pricing

Reference-based, or cost plus pricing, limits benefits for all or specified procedures to a specific dollar amount. With reference-based pricing, the benefit maximum (i.e. the reference cost) is predetermined for a selection of elective non-emergency outpatient procedures. Participants who elect to receive their care at a provider that charges above the reference price are responsible for the additional cost. Companies administer cost plus plans as a replacement to PPO networks, typically for inpatient facility charges. They set the reference price at a percentage above the Medicare reimbursement rate. For example, their reimbursements may be set at 120-150% of Medicare. The cost savings can be considerable, but balance billing is an issue.

Pharmacy Solutions

Pharmacy cost is now 15-20% of overall medical plan spend (and growing). To contain costs, many employers and insurance carriers have implemented programs such as mandatory generics, mandatory or incentivized mail order, step therapy, prior authorization, quantity limits, formulary management, and specialty pharmacy programs. Historically, the patient has been isolated from the actual cost of the medication they are filling, and has had no incentive to shop for lower cost alternatives, such as over the counter medications and generic or formulary equivalents. With high deductible health plans being offered more frequently, transparency is increasing and consumerism will hopefully impact pharmacy purchasing. For larger self-insured plans, we recommend a review of the pharmacy benefit management (PBM) contract to provide transparency into factors that impact cost such as drug manufacturer rebates, dispensing fees, Maximum Allowable Cost (MAC), and Average Wholesale Pricing (AWP).

New Networks

A cost management tool becoming more common is the narrowing of the PPO network to only include providers who practice evidence-based medicine and have proven quality. Some carriers and administrators are contracting with a narrower list of providers who agree to a larger discount in exchange for more volume. In some models, such as Accountable Care Organizations (ACOs), provider reimbursements are tied to quality metrics and reductions in the total cost of care for an assigned population of patients. This generally requires employees to either change providers to those within the narrower network or pay more for these providers that are now considered out-of-network. This can be a challenge in the Puget Sound marketplace where the providers often being removed include some long-standing, revered institutions.

Telemedicine

Thanks to robust advances in smart phone technology, a growing number of employees are given the ability to consult with doctors and nurses through two-way video, text, telephone or email for on-demand treatment of minor illnesses and common medical conditions. This convenient 24/7 access is provided at a fraction of the cost of an urgent care or emergency room visit. For significant impact on cost to occur, employee communication and education regarding the value and how to use a telemedicine program is crucial.

Onsite or Near Site Health Clinics

Onsite or near site clinic vendors can provide primary care to your employees in a medical home/evidence based care environment. These clinic models are designed to bring primary care to the workplace, giving employees better access to needed care, including on the job injuries and health coaching for those with chronic illnesses. According to a local onsite clinic vendor, in the first year, onsite clinics can reduce healthcare costs by an average of 25%, and reduce urgent care and emergency room claims by as much as 70%. This would require a disruption of current primary care relationships and would likely not include alternative care providers. Many forms of retail healthcare are also emerging, including provider groups and health plans embedding clinics in local pharmacy locations, improving convenience and access for their members and reducing urgent care and ER claims.

In conclusion, it is important to point out that, for any of these strategies to be effective in containing cost, an engaged, educated, and empowered employee/patient population is essential. Employers must be able to communicate the value of any given program to employees as a combination of personal cost savings to them, more convenience, and better health and well-being. An experienced employee benefits consulting firm like the team at Parker, Smith & Feek can identify which strategies are best for your company and employees, and the roadmap to implementing them successfully.

The views and opinions expressed within are those of the author(s) and do not necessarily reflect the official policy or position of Parker, Smith & Feek. While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it.