Employee Resiliency and Impacts on Productivity: Why You Should Promote Your Employee Assistance Program

March 2, 2021

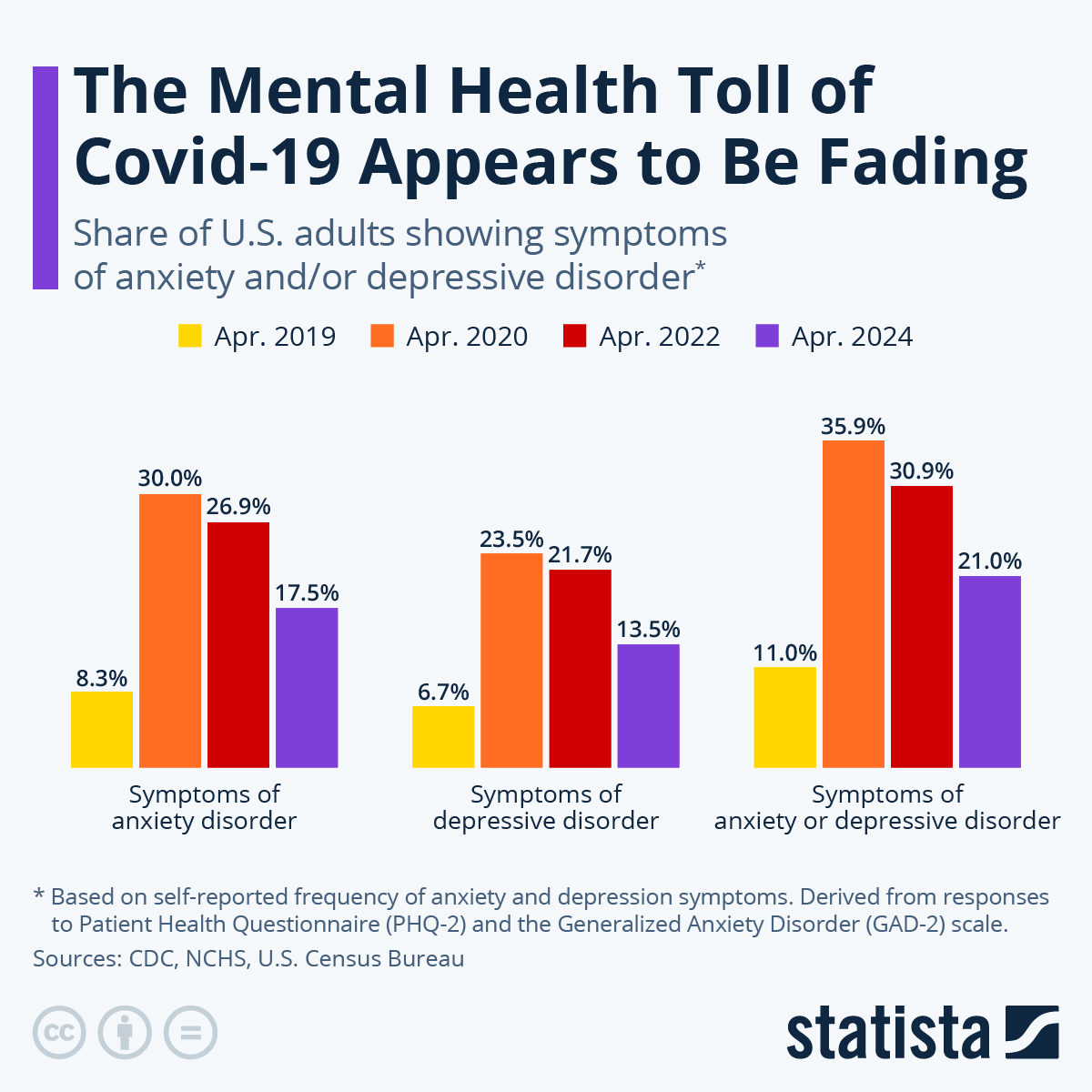

Studies show that inspired and engaged employees are 55% more productive, which can mean a great deal to a company struggling during the pandemic. However, regardless of whether your employees are working remotely or still coming into the office, they are likely experiencing some level of burnout from the fear, stress, and anxiety related to COVID-19. During the pandemic, about 4 in 10 adults in the U.S. have reported anxiety or depressive disorder symptoms, compared to 1 in 10 adults who reported these symptoms from January to June 2019.

Many individuals have taken on new roles as caregivers or teachers in addition to changing or new positions at work. These additional roles take a heavy toll on your employees’ mental, emotional, and physical well-being.

So how can employers support their workforce to ensure they are retaining valuable employees during this difficult time? Employers can combat burnout by leveraging programs designed to support these emerging, growing, or changing employee needs. In turn, this will help your employees to be more resilient in the face of crisis.

EAP Resources

Employee assistance programs (EAPs) are often thought of as a resource for mental health services. However, many programs also provide support surrounding family services, grief and loss, and financial planning. These three areas have been dramatically impacted by the COVID-19 pandemic.

Family Services

Following COVID-19 closures, employees have been challenged to find new daycare, elder care resources, tutors for children struggling with remote learning, family and marriage counseling, therapy for households stretched thin, and help for parents developing schedules, guidelines, and boundaries for homeschooling. EAPs have a wealth of resources available to help navigate and solve these issues and the stress and anxiety that accompany these life events.

Grief and Loss Counseling

Many of us have been impacted by the isolation of COVID-19, and some are coping with the loss of loved ones. Conventional resources and support that would be commonly available outside of our quarantined lifestyle are now out of reach. EAPs can help with virtual support tools to provide the connections your employees need during these difficult times.

Financial Planning

Employees’ households are also taking a big hit, grappling with making ends meet in the face of layoffs and furloughs. In some instances, dual-income families have become single income, with mortgages and bills piling up, adding significant stress to the remaining earner. EAPs can provide financial planning tools to help adjust budgets to survive the shortfall, restructure debt, or even help understand whether it would make sense to refinance or relocate.

Communicate with Employees

It’s great to have these tools available, but even more important is ensuring employees know how to access them and remove the stigma associated with asking for help. The best way to do this is through frequent communications throughout the year. Open enrollment meetings are a great start and can be shored up with topic-specific webinars, email blasts, and reminders in smaller, focused team meetings.

Often, EAPs are embedded in your existing programs, so it may not come with an additional cost to the plan. Most EAPs provide low or no-cost tools and resources and offer peace of mind to employees that there are options available to support them.

The issues reviewed in this article are only scratching the surface of the severity of situations your employees could be facing right now. There has been a significant increase in drug and alcohol abuse, domestic violence, and suicide in the past year. The chances are that at least one if not more of your employees are struggling with one of these issues.

Like the financial crisis of 2008, the aftershocks of the impact on our mental health will far outlast the physical impacts of COVID-19 itself. If you are interested in learning more about your existing EAP or setting one up, reach out to Parker, Smith & Feek’s Benefits Department.

Resources & References

- Adults Reporting Symptoms of Anxiety or Depressive Disorder During COVID-19 Pandemic, www.kff.org/other/state-indicator/adults-reporting-symptoms-of-anxiety-or-depressive-disorder-during-covid-19-pandemic/

- National Center for Health Statistics Household Pulse Survey on Anxiety and Depression, https://www.cdc.gov/nchs/covid19/pulse/mental-health.htm

- Pandemic Causes Spike in Anxiety and Depression Statista Infographic, www.statista.com/chart/21878/impact-of-coronavirus-pandemic-on-mental-health/

- The Pandemic is Widening a Corporate Productivity Gap, www.cdc.gov/nchs/covid19/pulse/mental-health.htm

- The Implications of COVID-19 for Mental Health and Substance Abuse, www.kff.org/coronavirus-covid-19/issue-brief/the-implications-of-covid-19-for-mental-health-and-substance-use/

- In Quarantine with an Abuser: Surge in Domestic Violence Reports Linked to Coronavirus, www.theguardian.com/us-news/2020/apr/03/coronavirus-quarantine-abuse-domestic-violence

The views and opinions expressed within are those of the author(s) and do not necessarily reflect the official policy or position of Parker, Smith & Feek. While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it.